All practising certificates issued in Victoria expire on 30 June each year. You must apply to renew your certificate if you want to continue to practise law after this date. This includes lawyers who received their first practising certificate any time before 30 June.

How to apply

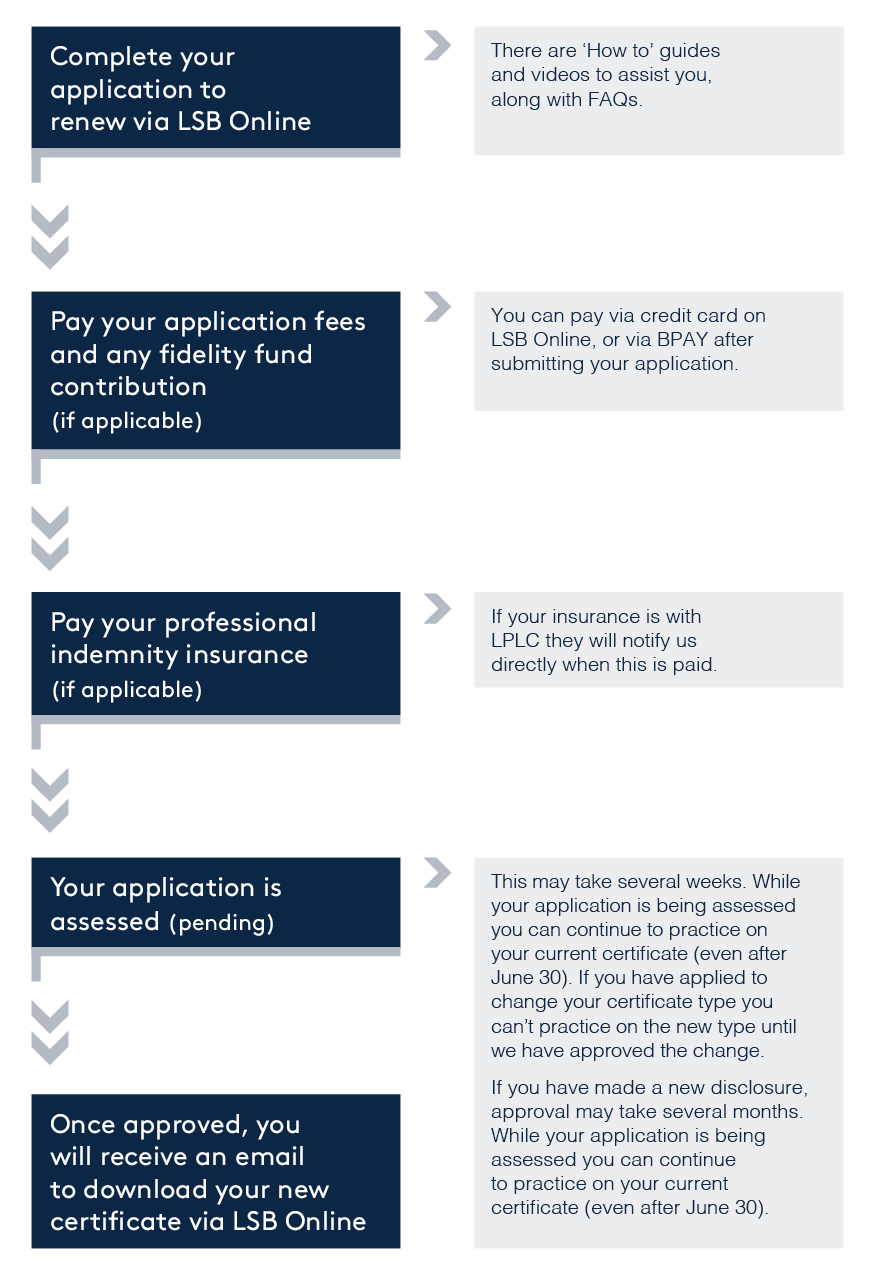

Login to your LSB Online account and follow the prompts. The application process explains all the information we need from you, and the fees you have to pay.

View the 'Renewing my practising certificate' user guide to help you with your application.

Fees

There are three types of fees that may apply to your practising certificate. These are:

- a prescribed fee for your type of practising certificate;

- a contribution to the Fidelity fund; and

- professional indemnity insurance.

Please note: we can't process your application if you have not paid your fees. You cannot practise law without a current practising certificate.

Practising certificate fees

The practising certificate fees for the current and previous year are listed on the Practising certificate fees page of our website.

How are payments made?

All payments are made through LSB Online and can be made by credit card or BPay. Organisations are no longer able to make bulk payments for their lawyers. We accept Visa, Master Card and Amex.

For assistance with paying practising certificate fees, please contact us via our Lawyer Enquiry form.

How much do you need to pay?

The table on the Practising certificate fees page lists the different fees payable for the different types of practising certificate.

Fees are scaled on a pro rata basis. Your fee will be based on when your certificate commences. Note: Fees do not attract GST.

If you are applying to renew your current certificate, your renewed certificate will commence on 1 July. You will need to pay the full fee for the whole year as shown in the fee column '1 July - 30 September' in the table below.

If you are applying for a new certificate (i.e. you are not renewing an existing certificate), your fee is based on the quarter that your certificate commences. For example, if your certificate commences on 10 February, your fee will be for the quarter commencing between '1 January - 31 March'.

Fidelity fund contributions

The Fidelity fund contributions for the current practising year are listed on the Fidelity fund page of our website.

There are different fidelity fund fee requirements for Victorian lawyers, foreign lawyers and approved barristers’ clerks. See the Fidelity Fund page for the fee category that applies to you.

Exempt lawyers

You do not have to pay a contribution if you are

- a barrister,

- a government lawyer,

- a corporate lawyer,

- an interstate lawyer,

- an employee or volunteer of a community legal service, or

- a principal or employee of a law practice that does not handle trust money.

Exempt foreign lawyers

- You do not have to pay a contribution if you hold a registration certificate that does not authorise you to receive trust money, and you work for a law practice that is not authorised to receive trust money.

- You do not have to pay a contribution if you hold a registration certificate that does not authorise you to receive trust money and you are not, and reasonably expect not to be, an associate of a law practice.

If you are a lawyer working in private practice or for a community legal service, you must be covered by a PII policy before you can practise law in Victoria. Corporate and government lawyers do not need to hold PII, except under certain circumstances.

Please view our professional indemnity insurance page for more information.

Deadlines and surcharges

You must apply to renew by 30 June. If you don't apply by 30 June, you will need to apply for a new practising certificate. You will incur a 200% surcharge on the practising certificate fee if you apply between 1 July and 30 September. If you are seeking a refund of or an exemption from the surcharge fee, we may request a declaration from you that you have not practised law since your last certificate expired. Depending on your circumstances, we may issue you a refund. Please see our 'Overpayment and Refunds policy'.

We cannot backdate practising certificates.

Not renewing?

If you don’t intend to continue to practise law, please log in to LSB Online and complete the ‘Not renewing’ form. This will take you off our follow-up and reminder mailing lists.

Need help with your renewal?

We have developed a range of resources to assist you to renew. Please visit the LSB Online resources page for more information.